Simple Advice for Personal Finance

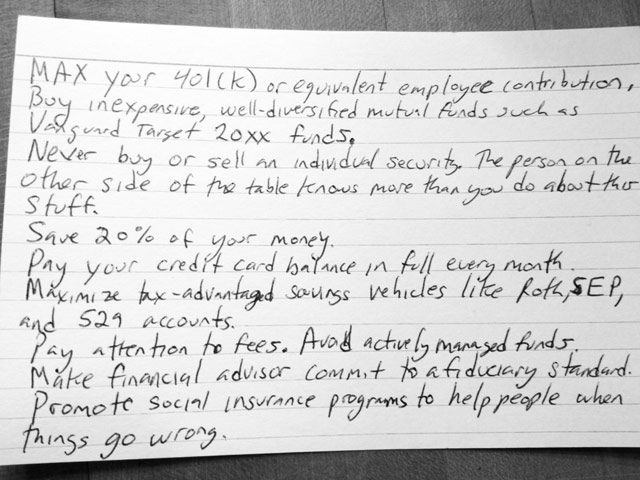

The Index Card is a new book by Helaine Olen and Harold Pollack about simple advice for personal finance. The idea for the book came about when Pollack jotted down financial advice that works for almost everyone on a 4x6 index card.

Now, Pollack teams up with Olen to explain why the ten simple rules of the index card outperform more complicated financial strategies. Inside is an easy-to-follow action plan that works in good times and bad, giving you the tools, knowledge, and confidence to seize control of your financial life.

I learned about their book from a piece by Oliver Burkeman on why complex questions can have simple answers.

But there’s a powerful truth here, which is that people dispensing financial advice are even less neutral than we realise. We’re good at spotting the obvious conflicts of interest: of course mortgage providers always think it’s a great time to buy a house; of course the sharp-suited guys from SpeedyMoola.co.uk think their payday loans are good value. But it’s more difficult to see that everyone offering advice has a deeper vested interest: they need you to believe things are complex enough to make their assistance worthwhile. It’s hard to make a living as a financial adviser by handing clients an index card and telling them never to return; and those stock-tipping columns in newspapers would be dull if all they ever said was “ignore stock tips”. Yes, the world of finance is complex, but it doesn’t follow that you need a complex strategy to navigate it.

There’s no reason to assume this situation only occurs with money, either. The human body is another staggeringly complex system, but based on current science, Michael Pollan’s seven-word guidance — “Eat food, not too much, mostly plants” — is probably wiser than all other diets.

Burkeman wrote one of my favorite books from the past year, The Antidote: Happiness for People Who Can’t Stand Positive Thinking.

Stay Connected